Century Regalia Cost Sheet

A cost sheet in real estate is a clear document that gives a detailed account of the various costs involved in a real estate project. It helps in understanding the total cost of a home or property.

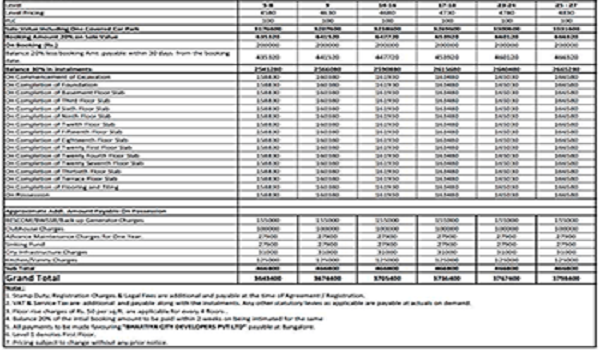

The Century Regalia cost sheet would encompass several components like the agreement value, other charges, stamp duty & taxes, development costs, maintenance charges, etc.

Century Regalia is a high-end residential project situated in the bustling city of Bangalore. It offers a range of 3 and 4 BHK apartments and is slated for completion by 2028. The project is designed with an emphasis on ultimate leisure and infinite comfort, with each detail meticulously planned for you to spend leisurely days and pleasant evenings filled with idyllic moments to cherish with your loved ones.

Key features of the project:

| Type | Residential |

| Project Status | Pre-launch |

| Site plan | 8.5 acres |

| Total units | 300 |

| Unit variants | 3 & 4 BHK |

| Price | On request |

| Towers and block | On request |

| Launch date | On request |

| Possession Date | On request |

Here are the main components of a cost sheet:

- Agreement Value: This is the price at which the property is agreed to be sold. It forms a major part of the cost sheet. The price for 3 BHK is between INR 1.05 Cr- INR 1.2 Cr approximately. The price for 4 BHK apartments is between INR 1.52 Cr- INR 1.72 Cr approx.

- Other Charges: These could include charges for amenities, parking, clubhouse membership, and more.

- Stamp Duty and Registration: These are government charges for registering the property in the buyer’s name.

- Taxes: Any applicable taxes are also included in the cost sheet.

- Estimated Land Cost: This includes the cost of the land, rights acquired for additional construction, litigation or settlement amount, and the amount remitted to clearance boards.

- Estimated Development Cost: This includes onsite costs (expenses related to the physical development of the project like men, material, machinery, and consultants fees), offsite costs (administrative costs, management costs), taxes or levies related to the development of the project, and borrowing costs.

The cost sheet also includes a payment schedule that shows the various milestones and the amounts that will become due at each milestone. This helps the buyer plan their finances and ensures that they are aware of all the costs involved in the purchase.

Stamp Duty and Registration are government charges for registering the property in the buyer’s name. These charges are usually a percentage of the agreement value and are mandatory for all property transactions.

Taxes are also a part of the cost sheet. These could include Goods & Services Tax (GST), property tax, and other applicable taxes. The amount of tax can vary depending on the location and type of property.

In conclusion, a cost sheet for Century Regalia provides a detailed account of all the costs involved in the purchase of a property in the project. It helps the buyer understand the total cost of the property and plan their finances accordingly. It is a useful tool for both the buyer and the developer as it provides transparency & helps prevent any misunderstandings or issues in the future.

| Enquiry |